In today’s fast-paced world, financial emergencies can strike at any moment. For many, payday loans offer a quick solution. But what exactly are payday loans, and why do they stir up so much debate? Let’s delve deep into understanding this controversial financial product.

Definition of Payday Loans

A payday loan is a short-term, high-interest loan designed to be repaid by the borrower’s next payday. These loans are typically for small amounts and are often used to cover unexpected expenses. The name “payday loan” stems from the idea that the loan is repaid when the borrower’s next paycheck arrives.

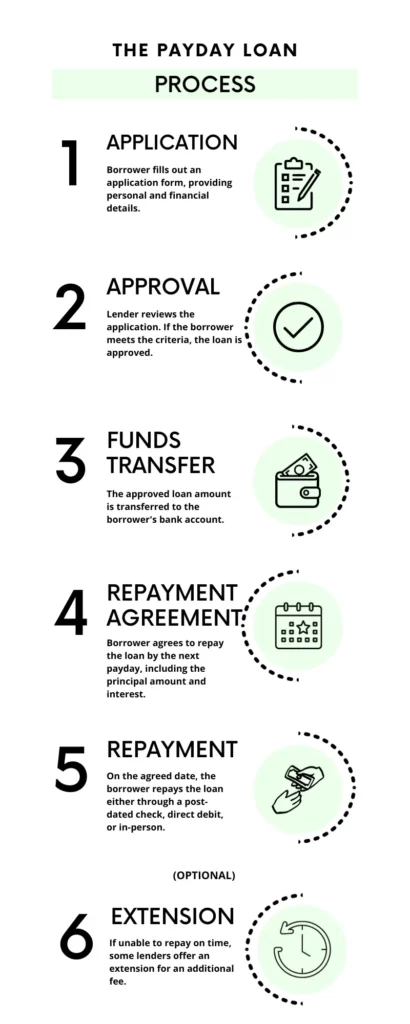

How Payday Loans Work

- Application: The borrower applies for a payday loan, either online or at a physical store.

- Approval: The lender reviews the application and, if approved, provides the loan amount.

- Repayment: The borrower agrees to repay the loan amount plus interest by their next payday.

- Extension (if needed): If the borrower cannot repay on time, some lenders offer an extension for an additional fee.

Pros and Cons of Payday Loans

Pros:

- Quick access to funds.

- Fewer application requirements compared to traditional loans.

- Can be useful for one-time emergencies.

Cons:

- Extremely high interest rates.

- Risk of falling into a debt trap.

- Not a long-term financial solution.

Alternatives to Payday Loans

- Personal Loans: Has longer repayment terms and generally lower interest rates.

- Credit Card Cash Advances: This allows you to withdraw cash from your credit card, usually at a lower interest rate than a payday loan.

- Borrowing from Friends or Family: This is usually a no-interest option, but can strain personal relationships if not repaid.

Real-life Stories

Jane (name changed), a single mother from Cape Town, once took a payday loan to cover her child’s medical bills. While it provided immediate relief, she struggled to repay due to the high interest. On the other hand, Mark (name changed) from Johannesburg successfully used a payday loan to fix his car and repaid it without any issues.

Expert Opinions

“Payday loans can be a double-edged sword. While they offer quick cash, the high interest can make repayment challenging,” says Hulisani N., a credit analyst from Johannesburg.

Conclusion

Payday loans can be a lifeline in emergencies, but it’s crucial to understand their terms and implications. Always explore alternatives and make informed decisions to safeguard your financial well-being.